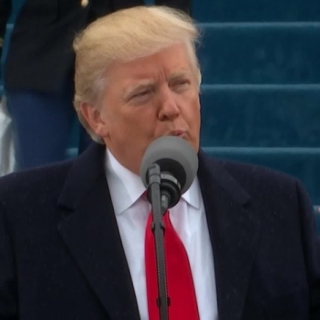

Global investors were stunned on Tuesday (August 26th) after US President Donald Trump renewed his attacks on the Federal Reserve's independence, caught between concerns over the politicization of policy and market benefits.

Trump's announcement that he was firing Fed Chair Lisa Cook caught markets by surprise, even though he had made it clear last week that Cook was a target and had been attacking Chairman Jerome Powell for months as part of his campaign to push the Fed to cut interest rates.

"This is another rift in the fabric of the United States and its investability," said Kyle Rodda, senior financial markets analyst at Capital.com in Melbourne. Rodda said he was concerned about the Trump administration's motives, suggesting the move was not about preserving the Fed's integrity, but rather about installing Trump's own people at the central bank.

"It goes back to trusting the institution," he said. While Cook's departure is not certain and she has denied Trump's authority to fire her, Trump's statement that her firing was "effective immediately" just two weeks before the Fed's policy meeting is another worrying factor for investors.

However, the market reaction was subdued. Short-term Treasury yields fell slightly, while expectations that the forced easing of monetary conditions would lead to inflation pushed the 30-year bond yield up 4.7 bps to 4.936%.

US S&P 500 stock futures fell only 0.07%, while the dollar index against a basket of currencies weakened 0.1%.

"People want to see if it will happen, but at the same time, it's very difficult to sell the US because of credibility issues," said Tohru Sasaki, Tokyo-based chief strategist at Fukuoka Financial Group. One factor investors need to consider is Trump's trade agreement, which requires countries in Europe, Japan, and South Korea to invest hundreds of billions of dollars in the United States, Sasaki said.

"If there's a lot of investment in the United States, the dollar will ultimately be supported, and so will US equities. So, you might lose money if you short the dollar or US assets." (alg)

Source: Reuters

Renewed tensions between the United States and Russia have resurfaced following an incident involving an oil tanker, sparking market concerns about potential disruptions to global energy supplies. Was...

According to a report from the US Department of Labor (DOL) released on Thursday, the number of Americans filing new applications for unemployment insurance rose to 208,000 for the week ending January...

Geopolitical issues have heated up again after statements and political signals from the United States sparked speculation about a possible US takeover of Greenland. Although no concrete action has be...

Private employment rose less than economists expected in December, according to the ADP report. Private employment rose 41,000 (Estimate +50,000) in December, compared with a revised -29,000 in Novem...

Greenland is not only a strategic location, but also a world-class mineral repository. The island holds vast reserves of rare earth elements (REEs), essential for modern technology. These minerals are...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...